Recover What You're Owed with Expert Debt Collection Attorneys!

Unpaid debts are hurting your business, but you don't have to write them off as losses. Our expert debt collection attorneys provide innovative legal solutions tailored to your unique situation. We're committed to recovering your assets while protecting your business relationships. Let us help you turn today's outstanding debts into tomorrow's recovered revenue.

Demand Letters & Settlement Negotiations

When debtors become unresponsive, professional demand letters offer a powerful first step toward debt recovery. Our experienced attorneys will draft legally compliant collection letters, initiate settlement negotiations, and ensure your rights are protected throughout the process while maximizing recovery potential.

Commercial Debt Collection

Commercial debt collection requires specialized knowledge of business law and collection regulations. Our dedicated experts craft personalized collection strategies that align with federal and state compliance requirements while protecting your business relationships. With us by your side, you can recover outstanding debts with professionalism, legal compliance, and maximum effectiveness.

Litigation & Judgment Enforcement

When debtors refuse to pay, litigation may be your best option. Our dedicated attorneys will file lawsuits, obtain judgments, and pursue enforcement through wage garnishment, asset seizure, and bank levies. We're here to protect your financial interests and ensure you recover what you're legally owed.

Asset Recovery & Collections

Are debtors hiding assets or refusing to pay valid judgments? Our legal team specializes in asset discovery, judgment enforcement, and post-judgment collection procedures. Let us protect your financial interests and help you recover outstanding debts through proven legal strategies.

Contract Breach & Business Disputes

Contract breaches don't have to mean lost revenue. Our attorneys specialize in business dispute resolution and breach of contract cases, offering solutions from demand letters to litigation. Together, we'll create a collection strategy that supports your business recovery and ensures long-term financial protection.

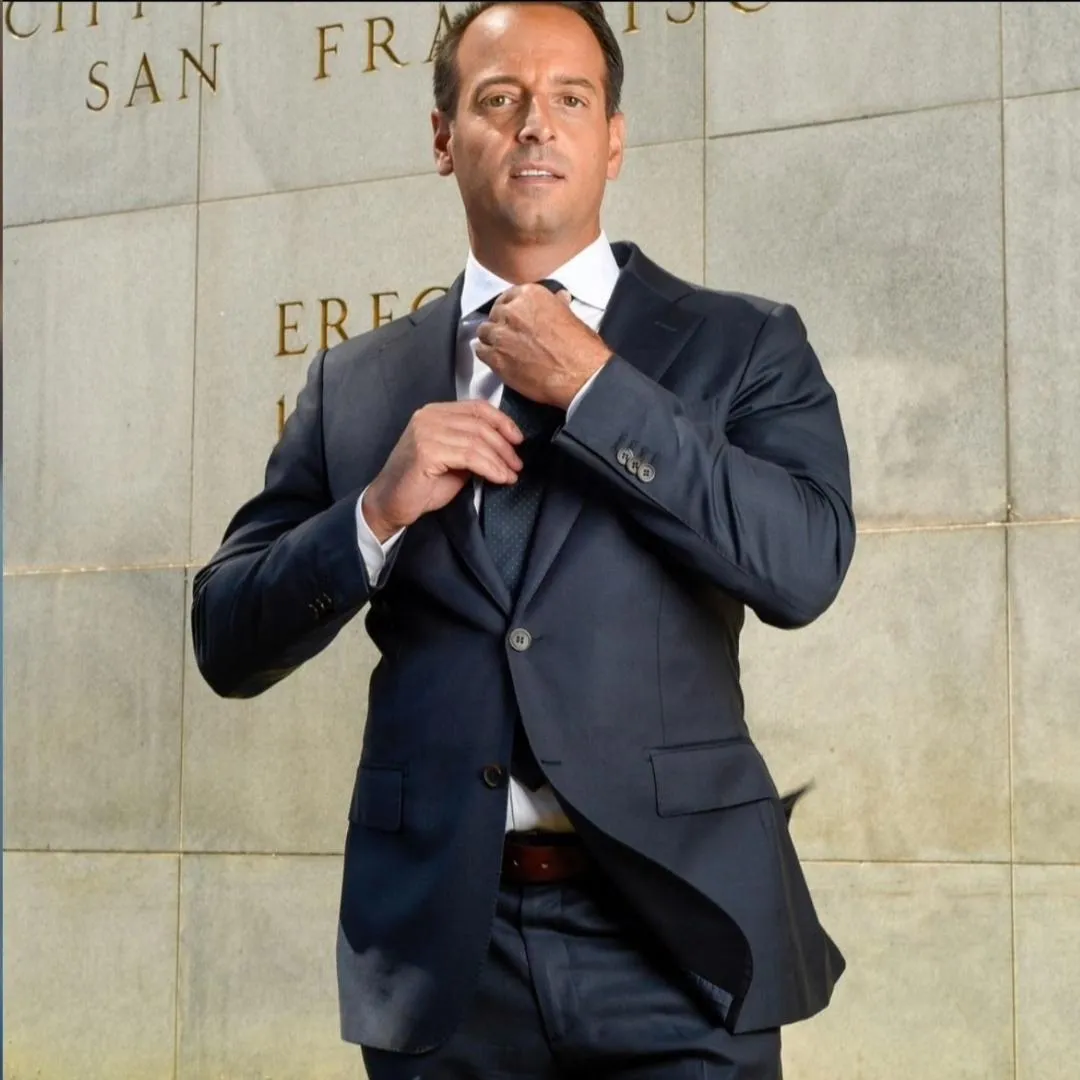

ABOUT US

Committed to Transforming Lives Through Expert Legal Services

Your Trusted Law Firm to Help You Rebuild Your Future

We are a team of experienced debt collection attorneys dedicated to helping businesses and individuals recover outstanding debts.

Our focus is on providing practical and aggressive legal solutions to help you achieve maximum debt recovery. With personalized collection strategies, we ensure your rights are protected throughout the entire process. Let us help you recover what you're owed with confidence and legal compliance.

Over a decade of experience in debt collection law and commercial litigation

Tailored legal collection strategies to meet your unique business needs

Aggressive advocacy through every step of the debt collection process

Proven track record of maximizing client debt recovery and protecting assets

Committed to helping you achieve long-term financial stability and cash flow

Two Decades of Expertise in Legal Cases – Proven Success in Every Field

With over 20 years of experience in debt collection and commercial litigation, we have built a reputation for providing aggressive and results-driven collection solutions. Our dedicated team of collection specialists is committed to achieving maximum recovery for every client. Whether you're dealing with commercial debts, contract breaches, or judgment enforcement, we're here to help you navigate the complexities of debt collection law with confidence.

250+ Business Partners

Extensive network of trusted collection partners who help us deliver top-notch debt recovery solutions

180+ Cases Done

Successfully collected over $50 million in outstanding debts, ensuring our clients' financial interests are protected

350+ Happy Clients

Over 350 satisfied business clients who have benefited from our aggressive and effective collection strategies

95% Case Success Rate

Recognized for collection excellence with a 95% success rate in debt recovery cases

TESTIMONIALS

What Our Clients Say About Us

I was completely overwhelmed with unpaid invoices until I found Alioto Law Group. Their unmatched expertise, aggressive approach, and step-by-step guidance made the entire debt collection process smooth and effective. I finally recovered over $75,000 in outstanding debts and now have a clear cash flow again!

– Sarah Mitchell

From our very first consultation, I immediately felt confident in their collection abilities and legal expertise. They explained every step of the debt recovery process clearly, addressed all my concerns, and fought aggressively to collect what was owed to my business. I couldn't have asked for better collection attorneys.

– James Carter

This team is not only highly professional but also genuinely cares about recovering what you're owed. They provided unwavering support, helping me navigate through difficult debtors with clear communication and aggressive collection strategies. I'm truly grateful for their dedication to my financial recovery.

– Emily Davis

Frequently Asked Questions

What's the difference between demand letters and filing a lawsuit for debt collection?

Demand letters are often the first step in professional debt collection, formally notifying debtors of their obligation and providing opportunity for voluntary payment. Filing a lawsuit becomes necessary when debtors are unresponsive or refuse to pay. Lawsuits result in court judgments that can be enforced through wage garnishment, asset seizure, and bank levies. Our attorneys help determine the best approach based on your specific situation, the debtor's assets, and the amount owed.

How will debt collection affect my business relationships?

Professional debt collection, when handled correctly, can actually preserve business relationships by establishing clear payment expectations and consequences. We focus on firm but professional communication that emphasizes legal obligations rather than personal attacks. Many clients find that proper collection procedures actually improve their business relationships by attracting more reliable customers and partners who respect clear payment terms.

Can I keep pursuing collection if the debtor files for bankruptcy?

Bankruptcy significantly affects collection efforts, and there are strict rules about continued collection activities. However, secured debts, certain business debts, and debts arising from fraud may still be collectible even in bankruptcy. Our legal team will help you understand your rights in bankruptcy proceedings and explore all available options to maximize recovery within legal boundaries.

What happens if we can't locate the debtor or their assets?

Asset discovery and debtor location services are crucial parts of successful debt collection. We utilize legal investigation tools, public records searches, and professional skip tracing to locate debtors and identify attachable assets. Even if initial location efforts are unsuccessful, judgments remain valid for years and can be renewed, allowing for future collection opportunities as circumstances change.

What types of debts can you help collect?

We handle various types of debt collection including commercial accounts receivable, breach of contract claims, unpaid invoices, business loans, personal guarantees, and judgment enforcement. However, we focus on substantial debts (minimum $25,000) where legal action is economically justified. Certain regulated debts like consumer credit accounts have specific legal requirements that we navigate carefully to ensure compliance.

Our team of dedicated collection professionals is ready to provide you with the aggressive legal representation you need. Whether you're facing stubborn debtors or need judgment enforcement, we're here to help. Reach out now to take the first step toward recovering what you're owed.

Our Services

Debt Relief Solutions

Bankruptcy Assistance

Bankruptcy Planning

Foreclosure Defense Services

Wage Garnishment Protection

Business Bankruptcy Services

Useful Links

Home

About Us

Our Services

Testimonials

Latest Blog

Help & FAQS

Contact Us

Subscribe Now

Stay updated with the latest debt collection strategies and legal insights. Subscribe now to receive expert collection tips, important regulatory updates, and helpful business resources directly in your inbox.

© Alioto Law Group 2026. All Rights Reserved.

Get Expert Advice Today!

We are committed to providing aggressive, expert debt collection services tailored to your unique business needs. Our dedicated collection team is here to support you every step of the way, whether you're pursuing commercial collections, contract enforcement, or judgment recovery. With years of collection experience, we ensure that your financial interests are protected and your outstanding debts are recovered. Contact us today and take the first step toward collecting what you're owed.